Debt Snowball APP

A debt reduction app can also help people understand that the order in which they pay off debts can have a dramatic impact on how much interest they pay over time.

Let’s look at an example using just two debts:

1) Credit card #1 = $12,000 debt at 17% interest

2) Credit card #2 = $5,000 debt at 13% interest

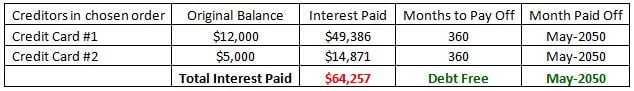

The first example shows paying the minimum payment to pay off debts in 30 years.

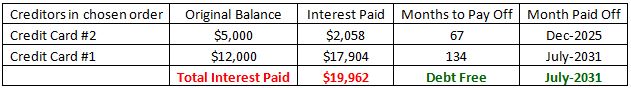

What if in the example you could come up with an extra $50 a month to pay towards your CC bills? That would be good, but the outcome will depend on where that $50 a month goes.

What if in the example you could come up with an extra $50 a month to pay towards your CC bills? That would be good, but the outcome will depend on where that $50 a month goes.

First, I’ll show the numbers for paying off the lowest debt value first (CC #2).

Second, I’ll show the numbers for paying off the highest interest rate debt first (CC #1).

Second, I’ll show the numbers for paying off the highest interest rate debt first (CC #1).

So, this would save you $2,860 in interest by paying off the highest rate CC first.

Why do you need this app? This sounds so simplistic, but most people don’t think critically about their money and how they choose to pay off debt. It’s one thing to think that paying off the highest rate CC should save more money, but it’s another thing to see the numbers for yourself.

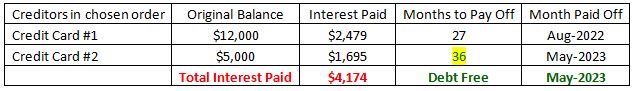

Debt reduction GOAL setting -this is what I think the app’s primary use will be. Pay off debts using the app and using the extra payment function to figure out how long it will take you to pay off your debts.

Using the same example, say you wanted to pay off both CCs in three years. How much extra per month(above the minimum payments) would be needed?

$375 a month extra and both debts will be paid off in 36 months.

That’s useful information if you are trying to make a budget.

That’s useful information if you are trying to make a budget.